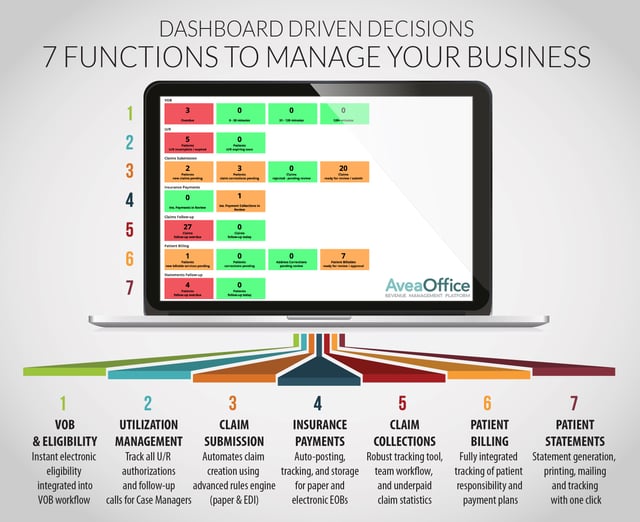

In our new weekly blog series, "Dashboard Driven Decisions," we'll be examining how addiction recovery, substance abuse and behavioral health organizations can greatly benefit from monitoring patient claims via electronic means, specifically via the use of a claims dashboard. Electronic claims management is faster, more organized and less error-prone than traditional methods, allowing your back office to work more effectively and you, in turn, to focus on growing your business.

Our first installment takes a look at how electronic verification of benefits and eligibility can help save you both time and money by figuring out from the start which patients will be the best fit for your organization.

Determine The Right Fit For You

You can’t accept everyone with an insurance card, so it’s important to determine the right fit for you as a provider. Payers and plans are constantly changing and there are limitations on who you can accept, so it’s important that you’re making sound decisions surrounding those submissions. If you come across a patient with a policy that won’t pay for a provider such as yourself, your staff can save themselves unnecessary frustration down the road by properly vetting patients from the beginning.

Save Yourself Valuable Time

Electronic VOB and eligibility also lets you know if a patient has active coverage and a plan that works with your program, allowing you to determine when to make that crucial benefits verification call. If you've been on one of these verification lines, you know it can take forever to get through and actually speak to a representative. You don’t want to be on hold with Blue Cross for 20 minutes only to find out that a patient has an HMO or in-network only policy and you can’t work with them. Electronic VOB saves you from dealing with this and similarly frustrating situations.

Reevalaute VOB on a Monthly Basis

Plans and eligibility are constantly changing, especially in this day and age with individually-funded plans. After admitting a patient, you need to ensure his or her policy is still active, and that no benefit changes have occurred. Don’t get caught off-guard by termed policies or dramatic changes that will affect you or your patient’s care. This is particularly relevant now as we see more patients coming through with Affordable Care Act policies which have 90-day grace periods. Often, a facility won’t know a patient is on his or her grace period if they don’t check VOB or eligibility, which can lead to interruptions in cash flow streams if the patient’s policy terms without your knowledge.

Check out our "7 Things Your Back Office Should Be Doing" webinar video and slide deck for greater insight into how dashboard-driven decisions can help you get the returns you deserve.

Further Reading:

- 3 Reasons Why Automation Is Essential for Claims Management

- 3 Key Enrollment Facts To Help Free Your Trapped Revenue

- Aspen Ridge & Avea: Sharing A Vision